Setting Up Stop Loss Orders

Stop loss order levels should be in fact consistent, else they will cost you money. Self-assertive levels are liable to be initiated by the ordinary cycle.

Base your stop losses on specialized levels, for example,

- Support/resistance levels,

- Above and/or below the latest peak/trough,

- Above and/or below reversal signals; or

- At the intersection of moving averages.

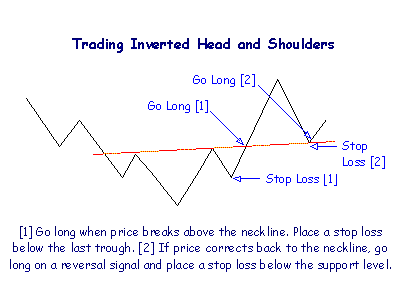

Example

This example represents the use of 2 diverse specialized levels for stop losses:

The primary stop loss is set just below the level of the latest trough.

The second stop-loss is put below the support line (on a reversal signal above the support line).

Backing and Resistance Levels

Avoid from setting your stop loss precisely at the support or resistance level for two reasons:

1. Trends regularly switch at these levels and you might be stopped out superfluously;

2. A large number of stops might be set at the support or resistance level, particularly where it has framed at a round number.

Rather set your stop loss one or two ticks below a support level or one or two ticks above a resistance level. For instance: If a support level has shaped at $20.00, set the stop loss at $19.90 so that you are only stopped out if the support level is penetrated.

I want to share with you all here on how I get my loan from Mr Benjamin who help me with loan of 400,000.00 Euro to improve my business, It was easy and swift when i apply for the loan when things was getting rough with my business Mr Benjamin grant me loan without delay. here is Mr Benjamin email/whatsapp contact: +1 989-394-3740, lfdsloans@outlook.com.

ReplyDeleteReal time SGX NIFTY current price. SGX Nifty live chart, Sgx Nifty live today, SGX Nifty, SGX Nifty futures, SGX Nifty chart, Singapore nifty. option tips

ReplyDeleteReal time SGX NIFTY current price. SGX Nifty live chart, Sgx Nifty live today, SGX Nifty, SGX Nifty futures, SGX Nifty chart, Singapore nifty. option trading tips

ReplyDelete14th Feb This post is very simple to read and appreciate without leaving any details out. Great work!

ReplyDeleteClasses I really thank you for the valuable info on this great subject and look forward to more great posts

ReplyDelete