Stop-loss orders or

"stops" are the limitation set by traders at which they will naturally enter or leave a trade - a request to buy or sell is put in the market if price achieves a predefined limit.

The principal discipline that any trader ought to master is to limit your losses.

A

stop-loss order will set to limit a trader's potential loss. The

stop loss is set below the present price (to ensure a long position) or above the present price (to secure a short position).

As a principle:

Avoid markets with low liquidity where extreme price fluctuations are possible.

Stop Loss Order Types:

Market Stop Orders

This is a traditional stop loss order - the stop initiates a market request to sell(or buy) at the common market price.

Limit Stop Orders

The limit stop activate an order to sell at the present market price yet not underneath a predetermined farthest point (or buy at the prevailing price up to a predefined limit).

Fixed Price Stop Orders

The stop loss activates an order at a fixed price. A few trades refer to these as a limit stop orders so watch that you are utilizing the right stop loss order.

Limit stop order is prescribed for entering a trade. They have a more prominent possibility of success than fixed price orders yet are not as open-ended as market orders (where your order will be executed regardless of what the market price is).

Market stop orders ought to be utilized to leave trades: to guarantee that the order has the best ideal possibility of execution. Never clutch securities if price falls forcefully - with the expectation that they will recover. Edwin Lefevre wholes up the quandary in Reminiscences of a Stock Operator :

"It was the same with all. They would not take a small loss at first but had held on, in the hope of a recovery that would "let them out even." And prices had sunk and sunk until the loss was so great it seemed only proper to hold on, if need be a year, for sooner or later prices must come back. But the break "shook them out," and prices just went so much lower because so many people had to sell, whether they would or not."

Assessment of Stop Losses

Stop loss orders don't generally work splendidly. If a major support level is breached, a large number of stops may be activated at the same time. Sellers will far surpass buyers, making price to fall forcefully and leaving sell orders unfilled. In compelling cases there might be no buyers at all for a security - not at any price.

Defective as they seem to be, stops are still a viable system for restricting danger and securing capital.

In the event that stops are not acknowledged in a market, set your own particular breaking points and put in buy and sell orders when the price is already reached.

Self-discipline is required to execute stops decisively.

Steps Required

1. In the first place, decide your gmaximum acceptable loss;

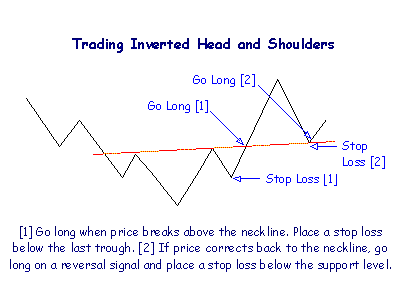

2. Set stop loss order levels taking into account sound specialized levels;

3. Modify your stop loss levels after some time to secure profits;

4. Use trailing stops to time your entrance and exit from the market.